Will Private Insurance Cover Medical Marijuana in Canada?

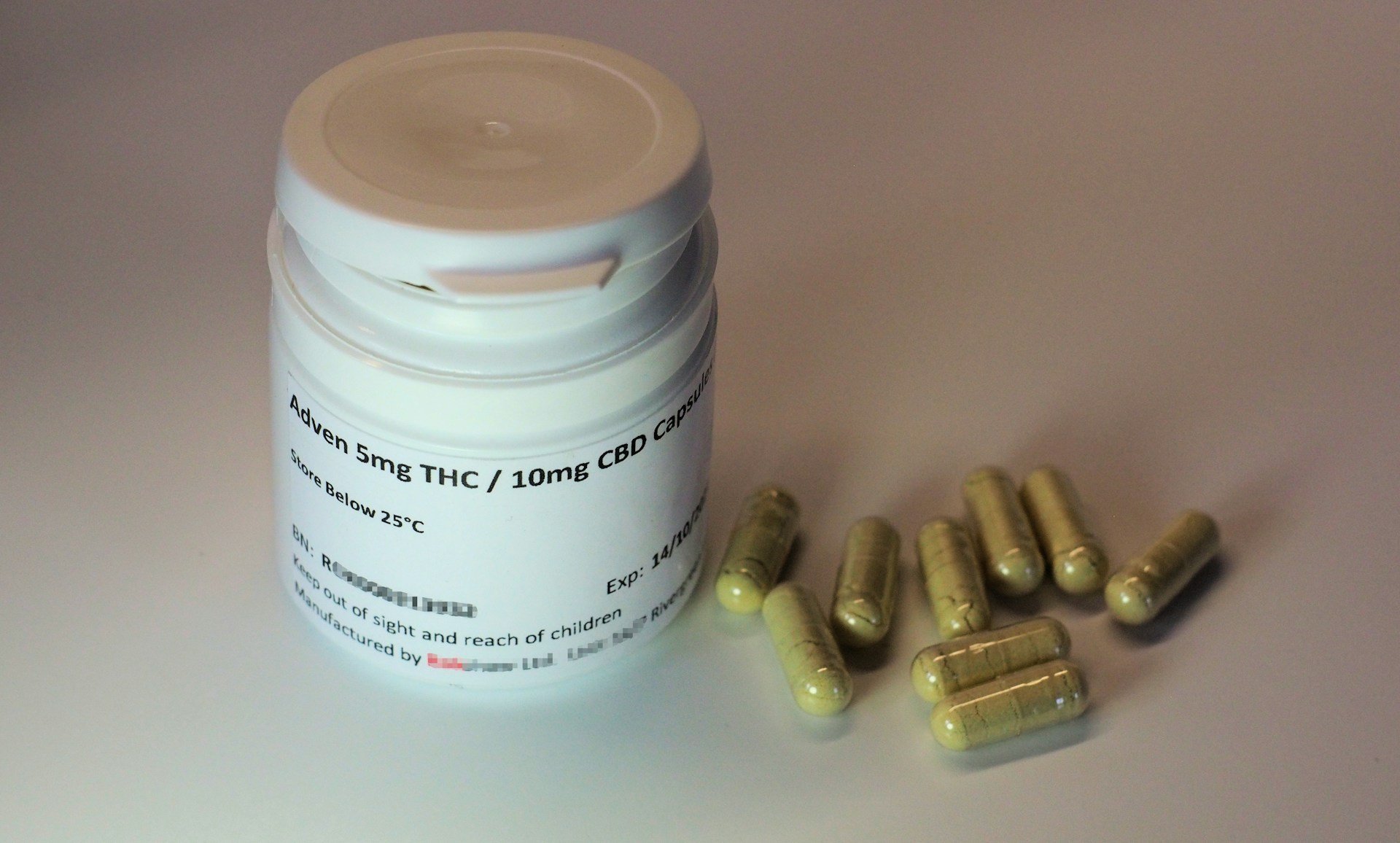

Since public health plans in Canada do not cover medical-use of marijuana, many are wondering whether there are private insurance options that will cover it instead. Marijuana is a drug made from cannabis plants which can have calming, pain-relieving effects, often used to reduce anxiety and chronic pain symptoms.

Since marijuana is used recreationally and habitually, securing coverage for medical-use can be difficult. Policyholders need to be able to prove their use of marijuana is for medical purposes. In this article, we’ll uncover whether medical marijuana can be covered with coverage limits from key insurance providers like Manulife, Sun Life, and more…

Will Private Health Insurance Cover Medical Marijuana in Canada?

Yes, some Canadian private health insurance providers will cover medical marijuana if it has been authorized by a doctor.

Steps to Get Private Health Insurance Coverage for Medical Marijuana

Book a consultation with a doctor or nurse practitioner to talk about your symptoms and condition. Keep in mind, some conditions aren’t eligible for treatment through medical marijuana. The doctor may suggest alternate treatment options if suitable.

If medical marijuana is the best treatment option, the doctor will provide a medical authorization. This authorization will help you secure coverage from a private insurer.

Register with a seller of medical marijuana that is federally-licensed.

To ensure your insurance will cover the costs, you should request pre-authorization from your private insurance provider.

Follow your private insurance provider’s instructions for making a claim.

Who Isn’t Eligible for Medical Marijuana Coverage?

Doctors and private insurers will usually avoid authorizing or covering the use of medical marijuana for:

Individuals under 25.

Individuals with a history of drug abuse and addiction.

Individuals who are pregnant, breastfeeding, or trying to conceive.

Individuals who could have an allergy risk.

Individuals who are taking a medication that can interact with marijuana and/or cause negative side effects.

Individuals with serious, high-risk diseases such as kidney disease, lung disease, and other applicable conditions.

Individuals who are at-risk of developing schizophrenia, psychosis, bipolar disorder, and other applicable mental conditions.

What Popular Canadian Insurance Providers Cover Medical Marijuana?

Manulife

Since 2018, Manulife has had a Medical Marijuana Program which can cover the cost of marijuana when used for medical purposes.

The program is specifically targeted at employer-sponsored group plans, but there is also coverage available for standard health plans as well. Speak with one of our licensed brokers for help finding a Manulife individual health plan that works for you.

Sun Life

Some insurance plans under Sun Life will cover medical marijuana.

Sun Life offers optional medical marijuana coverage under its Extended Health Care (EHC) plan to treat conditions like cancer, multiple sclerosis, rheumatoid arthritis, and HIV/AIDS. It can also be administered as a form of palliative care.

Help Me Find a Sun Life Health Plan that Works!

Blue Cross

Medavie Blue Cross has provided coverage for medical marijuana since 2018 through their Extended Health Care benefit.

Approved conditions/symptoms for medical marijuana coverage include chronic neuropathic pain, refractory pain in palliative cancer, nausea and vomiting due to cancer chemotherapy, and spasticity in multiple sclerosis or spinal cord injury.

Coverage is provided via reimbursement, meaning you must pay out-of-pocket first and request reimbursement later by providing a receipt of purchase. Maximums vary depending on your plan.

Help Me Find a Blue Cross Health Plan that Works!

Desjardins

Desjardins will cover medical marijuana on a case-by-case basis when prescribed by a doctor. Although it is primarily a supplemental benefit for group plans, standard plans that include drug coverage may also cover the cost. Policyholders need to request pre-authorization before becoming eligible for coverage.

Help Me Find a Desjardins Health Plan that Works!

Canada Life

Canada Life will cover medical marijuana, as long as the case meets requirements outlined in the Cannabis Act. They offer a dedicated pre-authorization form for medical marijuana coverage.

GreenShield

GreenShield will cover medical marijuana as a last resort treatment option for eligible individuals with chronic neuropathic pain, spasticity from multiple sclerosis, nausea and vomiting from cancer chemotherapy, palliative cancer pain, and seizures from dravet syndrome or lennox-gastaut syndrome.

Group Medical Services (GMS)

Unfortunately, GMS does not offer coverage for medical marijuana via their private health insurance plans. This may be because it’s considered by GMS to be an “experimental treatment”, all experimental treatments are not eligible for coverage with GMS.

Alternatives to Medical Marijuana for Chronic Pain

Gabapentin or pregabalin for nerve pain

Duloxetine or amitriptyline for neuropathic or fibromyalgia-related pain

NSAIDs such as ibuprofen or naproxen for inflammation.

Creams or patches containing lidocaine or capsaicin

Physical therapy, acupuncture, and massage therapy

In more severe cases, doctors may prescribe short-term opioids like tramadol or morphine

Alternative to Medical Marijuana for Anxiety and Mental Wellness

SSRIs like sertraline or escitalopram

SNRIs such as venlafaxine or duloxetine

Short-term benzodiazepines like lorazepam or clonazepam.

Cognitive Behavioural Therapy (CBT) and mindfulness therapy.

Regular meditation.