HealthQuotes Articles, Guaranteed Issue, Health Insurance, Retirees Aug 3 - Written by Krista DeKuyper

Top 3 Manulife Health Insurance Plans For Retirees in 2025

If you’re retired or retiring soon then that also means you’ll be losing your employee benefits. So you might be asking yourself ‘how can I still have health insurance?’. We’ve created a list of the top 3 Manulife health insurance plans for retirees.

Before going into the full list of retiree health insurance plans, there is one thing you need to consider. Do you have a pre-existing condition?

Yes, I Have A Pre-Existing Condition.

If you fall under this category then:

Consider a plan with no medical questions.

Acceptance is guaranteed.

Pre-existing conditions will be covered.

Premiums are tax deductible

To get instant quotes for guaranteed acceptance plans use this link!

No, I Don’t Have A Pre-Existing Condition

If you fall under this category then:

Consider a plan with medical questions.

Maximums are higher than no medical plans.

Pre-existing conditions will be excluded.

Premiums are tax deductible.

To get instant quotes for individual health plans use this link!

It’s important that you consider these factors as it will affect the type of plan that you are able to apply to. You don’t want to be applying for a health plan that doesn’t cover you existing medical condition. So make sure that you’ve considered these factors and then decide which plan is right for you.

The Best Health Insurance For Retirees

Manulife FollowMe

As a conversion plan FollowMe allows you to apply at any age and get as much coverage as you want for as long as you want. Your coverage is guaranteed with no medical questions when you apply and pay your first premium within 90 days.

Group conversion plans are ideal for Canadians who have pre-existing conditions and have lost employee benefits coverage due to retirement. Note, however, that you must apply for a group conversion plan within 90 days of losing your employee benefits coverage.

Check out our in depth blog of Manulife FollowMe to learn more.

Manulife Guaranteed Issue Enhanced

Unlike Manulife FollowMe, where you have to apply within 90 days of losing your employee benefits, Manulife Guaranteed Issue Enhanced allows you to apply for coverage at any time. Still, with no medical questions this health insurance plan for retirees is great for those who forgot to apply for additional coverage within the 90 days. You’ll be able to get the coverage you want at any time. Additionally, it offers enhanced prescription drug coverage!

Manulife Flexcare

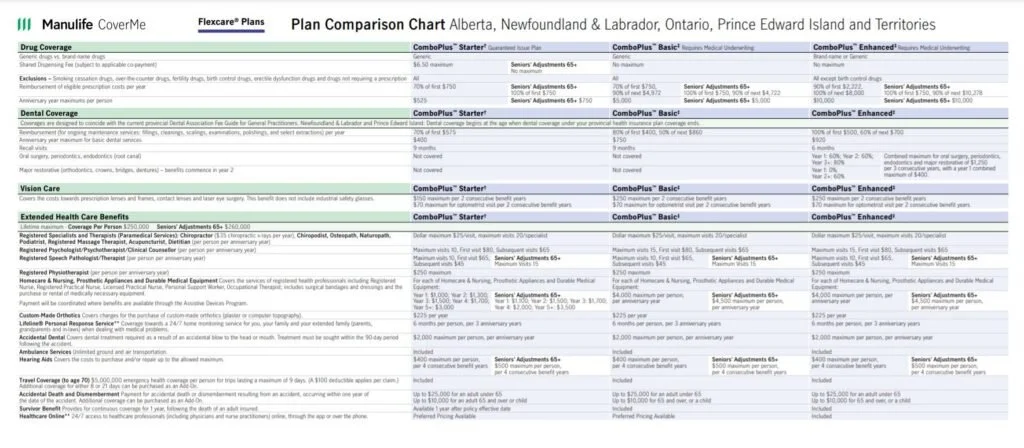

The next plan that is great for retirees is Manulife Flexcare. Manulife Flexcare is different from FollowMe and Bronze by being an individual health and insurance plan rather than a group conversion plan. This plan is great for those who do not have a pre-existing condition. You’ll be able to get higher deductibles and higher maximums. Additionally, what’s great about this plan is that there are senior adjustments on the drug coverage.

Check out the image below for more information here

Looking for quotes on any of these plans? Make sure to use our instant quoting tools or get in contact with our offices!