Cheapest Health and Dental Plans in Ontario in 2026

Jan 2026 - Written by Krista DeKuyper

Key Takeaways

Cheap health and dental plans are designed for basic protection, not full coverage.

The best way to find cheap coverage that meets your needs is to use this instant quote comparison tool, which automatically compares price points from every major carrier.

Most cheap plans fall between $60–$100/month, and every price point has trade-offs.

The lowest monthly premium often comes with lower annual caps, longer waiting periods, and limited reimbursement.

The cheapest plans aren’t always an option for those with demanding health needs.

Frequently Asked Questions

-

The insurance carrier with the cheapest health and dental insurance is Blue Cross. Their cheapest health and dental plan is the Complete Health Entry Plan with Entry Dental Benefits, going as low as $65/month.

-

Cheap health and dental plans don’t usually cover prescriptions. If a plan does cover both, coverage will usually be more limited.

Expect to see more exclusions, lower annual limits, and lower reimbursement rates on cheap plans that include both dental and prescription drug.

Typically, plans that have both dental and prescription drug coverage aren’t cheap. They cost more than $100/month on average.

Here are some cheaper health and dental plans that include prescription drug coverage:

-

No, dental services are not fully covered on cheap plans.

Cheap health and dental plans typically cover basic dental only, which includes routine cleanings and exams. Major dental services are usually excluded or capped very low.

Here are the health and dental plans that also cover major dental:

-

If you’re a freelancer, you’re not covered by employer-sponsored work benefits. You’d need a plan that is equally as comprehensive as traditional work benefits while also staying within your budget.

One of the strongest options available is the Manulife FlexCare DentalPlus Basic Plan, priced at approximately $90–$98 per month.

This plan stands out because it offers:

Strong dental coverage, including major services like extractions

Competitive pricing compared to similar plans

70% prescription drug coverage (up to $1,000 per year)

Coverage for paramedical services such as physiotherapy and chiropractic care

Basic vision benefits

For freelancers who want solid protection, this plan offers a strong balance of affordability and comprehensive coverage.

-

Cheap health and dental plans are hard to find because insurance pricing is based on how often benefits are used.

Dental is where most claims are made, and it’s one of the more expensive services that insurance covers.

This is why you’ll find that plans with the lowest monthly premiums often exclude dental.

-

Yes, you are welcome to upgrade your plan later if your health needs change.

However, keep in mind that upgrading will increase your premium based on your age and increasing coverage. It may also restart any waiting periods.

-

Cheap plans don’t usually cover pre-existing conditions.

Anything related to a pre-existing condition can be excluded from coverage. Additionally, your application could be denied entirely.

If you have a pre-existing condition, consider a guaranteed acceptance plan instead.

-

If you’re a student, your healthcare needs are typically lower than most. In this case, paying for an extensive, high-cost plan often doesn’t make sense.

A strong budget-friendly option is the Blue Cross Complete Health Entry Plan with the Entry Dental Benefit add-on, priced around $65–$75 per month.

This plan includes:

60% dental coverage (up to $500 per year)

A 3-month waiting period for dental services

Coverage for vision care

Paramedical services such as psychology, dietetics, and chiropractic care

It does not include prescription drugs, private nursing, or medical equipment — benefits that many younger students don’t need or typically use.

Where to Find Cheap Health and Dental Insurance Plans Online

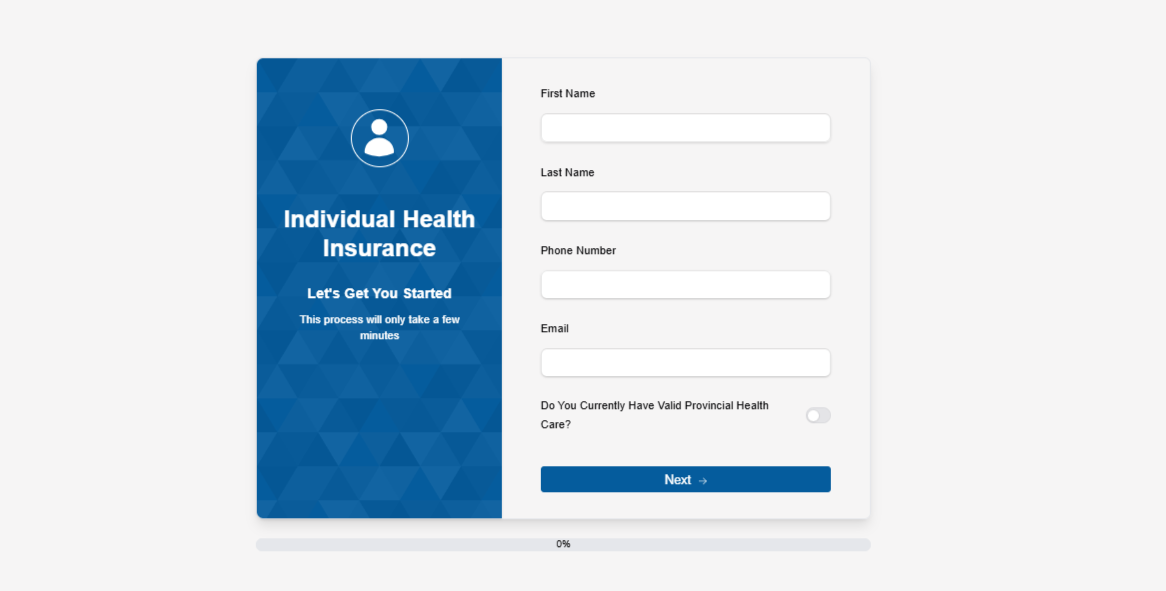

Use HealthQuotes’ Online Insurance Comparison Tool

All the information you need is already available on our instant online quoting tool. You will be asked to provide basic information about what type (dental, health, travel.etc) and level (basic, enhanced) of coverage you’re looking for.

Immediately, you’ll be provided with all the quotes available in Ontario that match your criteria.

Ask a Broker About the Cheapest Options Available

Our brokers have access to insurance quotes from carriers across Ontario. They can give you cheap options with personalized guidance on the pros and cons of each plan.

A broker is very helpful for those getting insurance for the first time, as they can give valuable advice based on their industry experience. They will also be there to assist when you have questions or if something goes wrong with your application.

What is Considered a Cheap Health and Dental Plan

Before diving in, we should clarify what a “cheap health and dental plan” means when making recommendations.

What is considered “cheap” varies from person-to-person. For this article, our criteria for a cheap health and dental plan is…

A plan that covers health & dental

A plan under at least $100/month

This means:

We are mainly focused on health and dental coverage. Other areas of coverage like prescription drug, paramedical, or travel are a “bonus”, but not essential.

We are judging cost based off the monthly premium for a single individual. Plans increase in cost when more than one person is covered by it.

We are using “under $100/month” as a baseline. However, this doesn’t mean every plan will reach the $100 mark. The cheapest option available will be priortized.

Cheap Health and Dental Plan Options in Ontario: From Provincial Coverage to Private Plans

| Program | Who It’s For | What It Covers (Dental + Health) | Cost | Limitations |

|---|---|---|---|---|

| Ontario Health Insurance Plan (OHIP) | Ontario residents who are Canadian citizens or permanent residents and physically present in Ontario at least 153 days per year. |

Dental: Limited dental surgeries performed in a hospital setting only. Health: Doctor visits, hospital care, medically necessary surgeries, diagnostic imaging, and certain specialist services. |

No premium for eligible residents. | Most routine and preventive dental care is not included. |

| Canadian Dental Care Plan (CDCP) | Canadian residents with adjusted family net income of $90,000 or less and no access to private dental benefits. | Dental Only: Exams, cleanings, fillings, root canals, gum treatments, oral surgery, anesthesia, and other medically necessary procedures. | No premium for eligible applicants. | Orthodontics generally excluded; coverage levels depend on income. |

| Healthy Smiles Ontario | Children and youth (0–17) from low-income households without other dental coverage. | Dental Only: Preventive services, emergency care, essential treatments. | No cost for eligible children. | Cosmetic procedures (e.g., whitening) not covered. |

| Ontario Seniors Dental Care Program (OSDCP) | Ontario residents aged 65+ with annual income of $25,000 or less and no private dental insurance. | Dental Only: Exams, x-rays, fillings, repairs, gum care, root canals, oral surgery, and related anesthesia. | No premium for eligible seniors. | Complex major procedures may not be included. |

| Private Dental Insurance | Individuals and families seeking broader dental and extended health coverage. |

Dental: Preventive, basic, and major services such as crowns, bridges, dentures, and often orthodontics (varies by plan). Health (varies by provider): Prescription drugs, vision care, paramedical services (massage, chiropractic, physiotherapy), mental health services, medical equipment, travel insurance, and more. |

$65–$155 per month (varies by provider and coverage level). | Waiting periods, annual maximums, and plan-specific exclusions may apply. |

Cheapest Health and Dental Plans by Insurance Carrier in 2026

Below you will find the cheapest health and dental plans available from Ontario’s top insurance providers: Manulife, Blue Cross, SunLife, and Canada Life. Along with the cheapest plan, we provide other options for those curious about adding on additional coverage.

The Cheapest Health and Dental Plan from Manulife

The cheapest health and dental plan from Manulife is the FlexCare DentalPlus Basic Plan for $90 to $98 per month.

| Plan Name | Manulife FlexCare DentalPlus Basic |

|---|---|

| Cost | $90 – $98 per month |

| Medical Questions | No medical questions required. |

| Dental Coverage | Covers services for fillings, cleanings, scaling, examinations, polishing, and select extractions. |

| Dental Reimbursement |

Year 1: 50% of the first $1,150 (anniversary year maximum of $575). Year 2+: 80% of the first $400 and 50% of the next $860 (anniversary year maximum of $750). Recall visits every 9 months. |

| Prescription Drugs | 70% coverage up to $1,000 per year. |

| Dental (Overall) | 80% coverage up to $750 per year. |

| Vision | $150 every 2 years. |

| Paramedical Services | $300 per practitioner per year. |

| Travel Insurance | Not included. |

Can I Get a Plan with More Dental Coverage?

For more dental coverage, Manulife offers FlexCare DentalPlus Enhanced for $145-$155. The plan includes more coverage for other services like paramedical, prescription drug, and travel.

Unfortunately, you will need to pay more if the DentalPlus Basic coverage isn’t enough.

FlexCare DentalPlus Enhanced: Dental Coverage Details

Covers services for: Fillings, cleanings, scaling, examinations, polishing, and select extractions, with added coverage for major restorative services.

Reimbursement:

Year 1: 70% payment of the first $1,200 (anniversary year maximum of $840).

Year 2+: 100% of the first $500 and 60% of the next $700 (anniversary year maximum of $920).

Recall visits: Every 6 months.

Is There a Cheaper Plan Available?

A cheaper plan with less dental coverage is the Manulife FlexCare ComboPlus Starter for $87 to $97. This plan includes both dental, prescription drug, vision, and paramedical.

Compared to the DentalPlus Basic plan above, ComboPlus covers a slightly lower percentage of dental costs (70% vs. 80%), with a lower annual maximum ($500/year vs. $750/year).

This is what helps the plan stay low-cost, but the DentalPlus Basic plan offers more dental coverage overall (80% up to $750/year).

FlexCare ComboPlus Starter: Coverage Details

Prescription Drugs: 70% coverage up to $500/year

Dental: 70% coverage up to $500/year

Vision: $150 every 2 years

Paramedical Services: $300 per practitioner/year

Travel Insurance: Not included

The Cheapest Health and Dental Plan from Blue Cross

The cheapest health and dental plan from Blue Cross is the Blue Cross Complete Health Entry with Entry Dental Benefit Add-on for $65 to $75 per month.

| Plan Name | Blue Cross Complete Health Entry with Entry Dental Benefit |

|---|---|

| Cost | $65 – $75 per month |

| Dental Coverage |

60% coverage, maximum $500 per calendar year. 3-month waiting period. |

| Dental Services Covered | Dental exam and cleaning, X-rays, fillings. |

| Dental Services Not Covered | Extractions, root canals, major dental work, orthodontics. |

| Health Practitioners (Covered) |

Psychologist: $55 per visit, up to $250 per calendar year. Physiotherapist: $40 per visit, up to $250 per calendar year. Chiropractor: $40 per visit, up to $250 per calendar year. Dietitian: $40 per visit, up to $250 per calendar year. Audiologist: $40 per visit, up to $250 per calendar year. Occupational Therapist: $40 per visit, up to $250 per calendar year. Osteopath: $40 per visit, up to $250 per calendar year. Podiatrist / Chiropodist: $40 per visit, up to $250 per calendar year. Speech Therapist: $40 per visit, up to $250 per calendar year. |

| Health Practitioners (Not Covered) | Massage therapist, acupuncturist, naturopath. |

| Additional Health Coverage |

Orthotics: Up to $150 per calendar year. Vision care: Up to $100 every 2 calendar years. Accidental dental: Up to $7,000 per lifetime. |

| Additional Coverage Not Included | Ambulance services, hearing aids, diabetic supplies, medical equipment, nursing services, prosthetics. |

| Prescription Drugs | No prescription drug coverage. |

| Travel Coverage | No travel coverage. |

Can I Get a Plan with More Dental Coverage?

Yes, you can upgrade your dental coverage from entry dental benefits to Essential Dental Benefits for $90-$97 (middle coverage) or Enhanced Dental Benefits for $127-$140 (highest coverage).

Blue Cross’s Essential Dental Benefits ($90-$97) Includes:

The same coverage from Complete Health Entry (paramedical, vision.etc)

70% dental coverage with no overall maximum

6-month waiting period

Coverage for:

Dental exam & cleaning, X-rays, Fillings

Extractions

Root canals

Blue Cross’s Enhanced Dental Benefits ($127-$140) Includes:

The same coverage from Complete Health Entry (paramedical, vision.etc)

80% coverage with no overall maximum

6-month waiting period

Coverage for:

Dental exam & cleaning, X-rays, Fillings, Extractions, & Root canals

Periodontal services ($1,200/CY)

Major dental ($500/CY)

Orthodontics for people 18 and under ($1,500 LT Reimbursement limit $125/month)

How Much Would It Cost to Add Prescription Drug Coverage?

Adding entry prescription drug coverage would bring your monthly premium up to $104-$112 (Complete Health Entry + Entry Dental Add-on + Essential Drug Add-on*).

Essential Drug Add-on* ($104-$112): Coverage Details

The same coverage from Complete Health Entry (paramedical, vision.etc)

The same coverage from Entry Dental Benefits (dental exam & cleaning, X-rays, fillings.etc)

70% drug coverage with no overall maximum

100% coverage after eligible claims reach $4,500 in a year

Maximum co-pay per prescription: $100 (maximum $1,350/CY)

Covers birth control and smoking cessation (both are often excluded in other prescription drug plans)

Dental and prescription drugs are two of the most expensive parts of an insurance plan, so keep that in mind when considering what coverage is essential for you.

*Blue Cross only offers prescription drug coverage at the essential and enhanced level. There is no entry-level prescription drug add-on available at this time.

Find Cheap Insurance Quotes Instantly

Skip the guide and start finding cheap health and dental plans that meet your needs right now.

The Cheapest Health and Dental Plan from Sun Life

The cheapest health and dental plan from Sun Life is the Sun Life Basic Plan for $62 to $80 per month.

| Plan Name | Sun Life Basic Plan |

|---|---|

| Cost | $62 – $80 per month |

| Prescription Drugs |

60% coverage up to $750 per year. Oral contraceptives are excluded. |

| Vision | No coverage. |

| Supplemental Health Care | 60% coverage for medical equipment and services. |

| Paramedical Services |

$25 per visit, up to $250 per year. Includes services such as massage therapists and speech pathologists. |

| Psychologists / Social Workers | $35 per visit, up to $500 per year. |

| Emergency Travel Medical | No coverage. |

| Dental Coverage |

Preventative dental care included. 60% reimbursement up to a $500 annual maximum. 3-month waiting period applies. |

How Much Would It Cost to Add Vision and/or Emergency Travel?

Vision and emergency travel coverage is not included in the basic plan. To get vision and/or travel coverage, you will need to upgrade to a Standard Plan.

Sun Life’s Standard Plan with Dental will cost around $150-$170.

Here are the coverage details for a Standard Plan with Dental ($150-$170):

Dental

Preventative: 70% up to $750 (starts after 3 months)

Drugs: 70% up to $7,000, 100% for the next $93,000

Vision

100% up to $250 (starts after 1 year)

$50 per eye exam (every 2 years for adults)

Supplemental health care: 100% for medical equipment and services

Paramedical: 100% up to $300 per practitioner

Psychologists / Social workers: 100% up to $1,000

Emergency travel medical coverage: Coverage for the first 60 days of your trip

How Much for Dental Coverage That Includes Restorative and Orthodontic Services?

The basic and standard plans only cover preventative dental. You will need to upgrade to the highest-tier Sunlife Enhanced Plan for $240-$255 to get restorative and orthodontic dental coverage.

Here’s what Sunlife’s Enhanced Plan with Dental ($240-$255) will cover:

Drugs: 80% up to $5,000, 100% for the next $245,000

Vision

100% up to $300 (starts after 1 year)

$50 per eye exam (every 2 years for adults)

Supplemental health care

100% for medical equipment and services

Paramedical: 100% up to $400 per practitioner

Psychologists / Social workers: 100% up to $1,500

Emergency travel medical coverage: Coverage for the first 60 days of your trip

Dental

Preventive: 80% up to $750 (starts after 3 months)

Restorative: 50% up to $500 (starts after 1 year)

Orthodontics: 60% up to $1,500 lifetime max (starts after 2 years)

The Cheapest Health and Dental Plan from Canada Life

The cheapest health and dental plan from Canada Life is the Canada Life Select Plan for $90 to $100 per month.

| Plan Name | Canada Life Select Plan |

|---|---|

| Cost | $90 – $100 per month |

| Medical Underwriting | Requires medical underwriting. |

| Prescription Drugs* | 70% coverage up to $500 per person each calendar year.* |

| Dental Coverage |

Routine dental: 70% coverage up to $350 per person per calendar year. Dental accidents: 100% coverage. Major dental: Not covered. |

| Paramedical Services |

100% coverage up to $30 per visit. Maximum of $300 per practitioner each calendar year. |

| Vision |

Eye exams: 100% coverage for one exam up to $75 every 2 years. Eyeglasses, contact lenses, and laser eye surgery: 100% coverage up to $150 per person every 2 years. |

| Hospital Accommodation | No coverage. |

| Ambulance Services | 100% coverage of reasonable and customary fees, including air ambulance. |

| In-Home Nursing & Home Health Aide Care | 100% coverage up to a combined maximum of $2,500 per person per year. |

| Medical Supplies | 100% coverage up to the maximum outlined in the policy for approved rental or purchase. |

*The Select Plan does not cover prescription drugs you are already taking, or future prescriptions related to any pre-existing medical conditions.

Which Health and Dental Plan Is the Most Cost-Effective?

The most cost-effective plan is Manulife’s FlexCare DentalPlus Basic Plan.

Manulife FlexCare DentalPlus Basic Plan

$90 to $98 per month

How is FlexCare DentalPlus Basic the Most Cost-Effective?

When talking about cost-effective plans, we’re evaluating the amount of coverage you’re getting relative to what you pay in premiums. Manulife offers the best coverage for the lowest price, with 80% coverage after year 2 (higher than average), no waiting period, and less restrictive exclusions (most plans won't cover any extractions).

Best Health and Dental Plans Based on Budget

| Under $70 / Month |

Blue Cross Complete Health Entry + Entry Dental

$65–$75 / month

|

|---|---|

| $70–$85 / Month |

Blue Cross Complete Health Enhanced

Starting at $70 / month

Sun Life Basic Plan

$62–$80 / month

|

| $90–$100 / Month |

Manulife FlexCare DentalPlus Basic

$90–$98 / month

Canada Life Select Plan

$90–$100 / month

Blue Cross Complete Health Entry with Essential Dental Benefits

$90–$97 / month

|

| $100+ / Month |

Manulife FlexCare ComboPlus Enhanced

Starting at $190 / month

Blue Cross Complete Health Entry with Enhanced Dental Benefits

$127-$140 / month

Sun Life Enhanced Plan with Dental

$240-$255 / month

|

Get Started with a Free Quote

Get the information you need without needing to phone or speak to a broker.

The Drawbacks of Cheap Health Insurance: When to Consider Increasing Your Budget

Cheap health and dental insurance plans can be a good starting point…but they aren’t the right fit for everyone.

The Drawbacks

High out-of-pocket costs: Low premiums often mean high deductibles and co-pays.

Reduced coverage: Cheaper plans often have more limited or excluded services.

Poor coverage for chronic conditions: Low-cost plans are not designed to cover ongoing care.

Less long-term value: A cheaper plan usually means you pay more out-of-pocket, making it less valuable overall.

Cheap health and dental may not be suitable for people who…

Have ongoing medical needs

Require extensive dental care (orthodontics, restorative dental work.etc)

Want immediate coverage (no waiting period)

Are getting insurance for family

Want to limit out-of-pocket costs as much as possible.

Want comprehensive, all-encompassing coverage (no exclusions).

Tips for Finding a Cheap Health and Dental Insurance Quote

Understand What You’ll Actually Use

If you rarely use eyeglasses or prescriptions for example, a basic plan that excludes it should be fine for you. Paying for coverage you won’t use is how many Canadians end up overspending.

Watch for Waiting Periods

Many cheap plans have waiting periods for dental, vision, and paramedical services — sometimes up to 12 months. If you need coverage soon, look for shorter waiting periods and immediate dental/drug coverage.

Compare Coverage Limits, Not Just Price

A $20/month plan with a $300 annual limit may cost more out-of-pocket than a $40/month plan with $1,000+ in coverage. Compare annual maximums and reimbursement percentages, not just price.

Choose Individual Coverage if Possible

Family plans sound convenient, but they can dilute coverage, and cost significantly more. Sometimes, investing in separate individual plans for the family costs less overall and offers better coverage.

Compare Cheap Health and Dental Quotes for Free

Easily compare quotes offered by Ontario’s health insurance providers