How to Handle a Denied Health Insurance Claim After Surgery

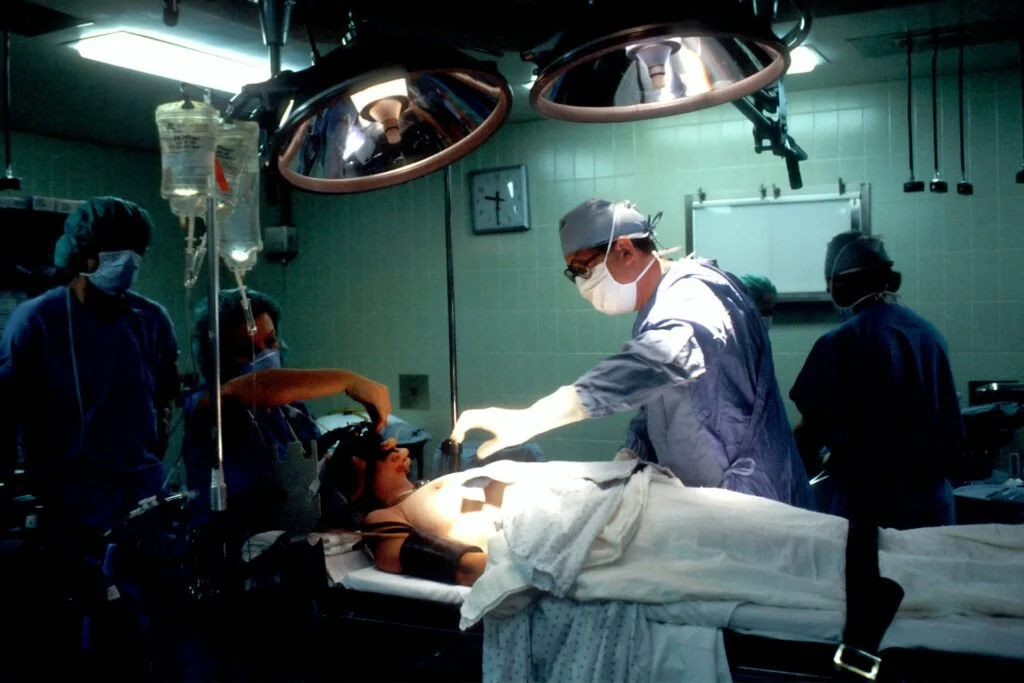

Picture this: You’re about to leave the hospital after recovering from a major surgery. A member of the hospital staff approaches you about your bill and if you’d like to discuss payment options. This bewilders you, as you’d already received authorization for the surgery from your insurance provider. Your insurance authorized the claim, but it was rejected post-surgery.

Whether you’ve been in this exact situation, or experienced something akin to it, nothing is worse than unexpectedly paying out-of-pocket. Denied health insurance claims are not only frustrating, but also have a detrimental impact on your finances. In this article, we’ll show you how to navigate a rejected health insurance claim post-surgery.

Why Your Health Insurance Claim Was Denied

Un-Disclosed Health Issues: If you failed to disclose important medical information when applying, future claims related to the issue will be denied.

Your Surgery is Classified as Elective or Ineligible: If your surgery is not considered medically necessary, your insurer will not cover any related medical expenses.

Billing or Documentation Errors: Inconsistencies in your paperwork will lead to rejection. Have your healthcare provider re-review billing to ensure all information is accurate. Review any other documentation related to your surgery. Watch out for discrepancies such as missing signatures or documentation.

Authorization Issues: While you may have received initial authorization, the insurance company may later determine that the treatment did not conform to the agreed-upon details.

Out-of-Network Services: If the surgeon or hospital is not part of your health insurance network, this can lead to denials, especially for non-emergency procedures.

Can Pre-Authorized Health Insurance Claims Be Denied?

Yes, your claims can still be denied even if they were pre-authorized. The pre-authorization process means your insurance provider agrees that a medically necessary service is eligible. It does not guarantee payment. Denials could occur based on final reviews of the claim and additional information provided after the procedure, such as:

Any pre-existing conditions that may affect coverage.

Further review of medical necessity.

Differences between what was authorized and what was ultimately billed.

The First Steps to Take After a Denial

Review the Denial Notice: Read the denial letter to understand why the claim was rejected. Look for any specific codes or explanations that will clarify the reason for the denial.

Gather Documentation: Collect all necessary documents related to the surgery, including bills, medical records, and previous correspondence regarding pre-authorization.

Contact Your Healthcare Provider: Reach out to your surgeon or the hospital’s billing department. They often have insights into the denial process and will help clarify billing or documentation issues.

Contact Your Insurance Company: Call the customer service number available on your insurance card. Ask for more information on the denial and what steps need to be taken to resolve it.

How to Appeal a Denied Health Insurance Claim

After reviewing your policy and the reason for the denial, you may choose to appeal the decision if you believe the insurance provider rejected your claim wrongfully. Here’s how to do it:

File a Formal Appeal: Write a letter to your insurance company outlining your case. Include all relevant documentation, such as medical records, bills, and the denial letter. Cite specific portions in the policy that back up your right for coverage. For example, if the policy notes that your surgery is medically necessary and should receive coverage, mention that in your appeal.

Confirm Appeal Procedures: Each insurance provider has specific processes for filing appeals, which may include timelines and forms. Make sure to follow your specific provider’s guidelines to ensure your appeal remains valid.

Follow-Up Communication: When you submit your appeal, take the time to record all correspondence regarding your appeal. Follow up with your insurance company and regularly ask about the status of your appeal.

Seek Support: Your healthcare provider or a health insurance advocate will have experience working with your insurance provider and can provide helpful guidance and assistance to strengthen your claim.

Consider Switching Insurance Providers with HealthQuotes

If you find yourself dealing with rejected claims often, it may be time to pursue other insurance options. Ready to find the insurance plan you need? Contact HealthQuotes’ registered insurance brokers for a seamless transition. When a client approaches us to find them an insurance plan, we prioritize their needs and preferences above all else. Since we started business, this approach has been the key to our success. We work for you, not for the insurance providers.