How Much Are You Paying for Public Health Care?

By Krista DeKuyper | May 17, 2021 |

How Much is Health Care in Canada

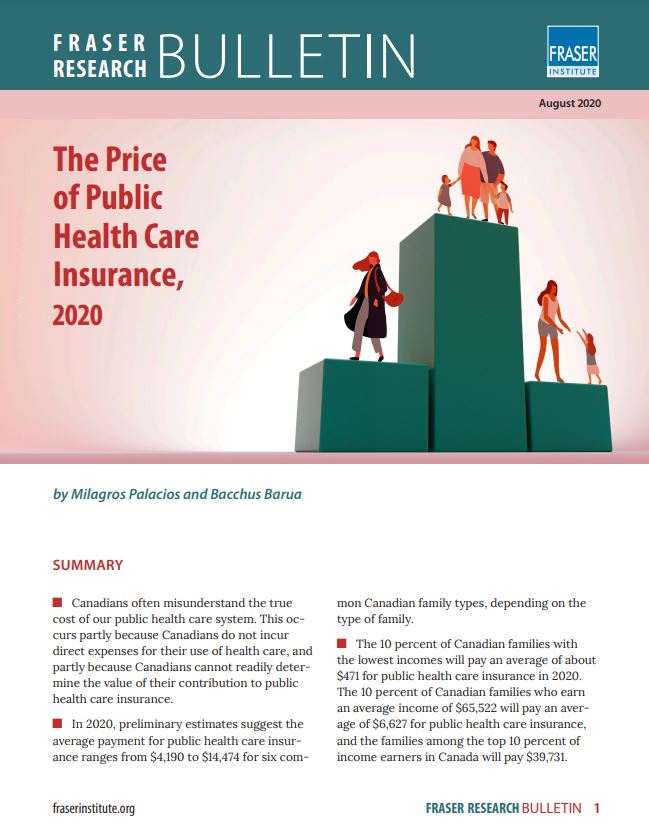

Canadians often don’t understand the true cost of the public healthcare system. This is because Canadian’s don’t incur a direct expense for their use of health care making it difficult to determine the true value of the contribution to public health care.

A research report done by Fraser Institute found that in 2020 the average payment for public health care insurance ranges from $4,190 to $14,474 for six common Canadian family types. Furthermore, the 10 percent of Canadian families with the lowest incomes will pay an average of about $471 for public health care and the families that amount to the top 10 percent of income earners in Canada will pay $39,731. In 2019 approximately $172 billion of Canadian tax dollars were estimated to have been spent on publicly funded health care. Which is approximately $4,582 per Canadian.

It hard to determine the contribution value for public heath care because there is no dedicated tax. But rather it is financed through general government revenues. Including income taxes, employment insurance, Canadian Pension Plan premiums, property taxes, profit taxes, sales taxes, taxes on the consumption of alcohol and tobacco, and import duties among others. Because of this one can only estimate how much you are paying for public health care.

You can download the full report here

Why Is This Important To You?

You might ask yourself, ok great but why is this important? Why should I know about this? The writers of the report aim to give Canadians health care spending specifics so Canadians can have more informed conversations about how the health care system is serving them. If you’re paying for public health care you want it to be working right?

It also means that your hard earned money might not be getting you the services you want. Just like with anything else you spend your money on you want to make sure that everything is running smoothly and that it’s meeting your expectations. If it’s not you can then do something about it.

With cuts to healthcare made by the government in the past decade more and more people are in need of or are searching for additional health insurance.

What if I Have Minimal Medical Expenses?

On the other hand, some people don’t want to get insurance because they have minimal medical expenses. Well in addition to the tax deductions you might be entitled for, the cost of your individual health insurance will likely be lower than the medical bills you would have to pay out of pocket without the coverage. As the saying goes, it’s better to have it and not need it than to need it and not have it.

Things to Consider When Choosing Your Plan

With all that said, here are 3 tips to help you choose the best insurance plan for you.

- Check what’s covered by your provincial health care

- Some things that have been covered in previous years might not be currently covered. That’s why you will want to be well informed about what is exactly covered by the provincial plan.

- Policy Use

- Figure out how you will use the plan. If you have minimal medical expenses and you find that you don’t need all the extended coverage than it may be beneficial for you to purchase basic coverage.

- Think about the future needs of yourself and your family

- You can’t just think about the present when it comes to figuring out which insurance plan to go with. You also need to think about the future and what your family might need. For example, think about family health problems that could potentially affect you or your family.

HealthQuotes Can Help

Interested in researching different insurance plans? HealthQuotes offers an instant quoting tool where you can compare different quotes from leading insurance providers. A free consultation with a licensed experienced Canadian broker is available ONLY if you would like to talk to an expert.

For anymore information please send us an email at inquiries@healthquotes.ca